Why You Must Treat Financial Freedom Like a Program

When I retired early in my early 40s, I learned that most people treat financial freedom as an impossible, distant dream. But I had done it for myself, and I knew that if I could do it, anyone could.

Financial freedom feels impossible when you treat it like a distant dream. It becomes achievable only when you treat it like a professional program.

I wasn’t educated for it. I had no financial advantage—quite the opposite, actually. I started with over $100k of debt and didn’t even know what a retirement account was. Yet, thanks to my career as a Program Manager, I learned the tools I needed to get organized and make that dream a reality.

The Program Advantage

While working as a Program Manager at some of the largest global companies in the world, I learned how to use professional frameworks to break down complex strategies into executable tasks. I realized I could apply those same approaches to my own financial freedom.

It worked so well that I finally escaped “autopilot.” I achieved financial independence and decided to retire early at the age of 43 (two years before my actual target).

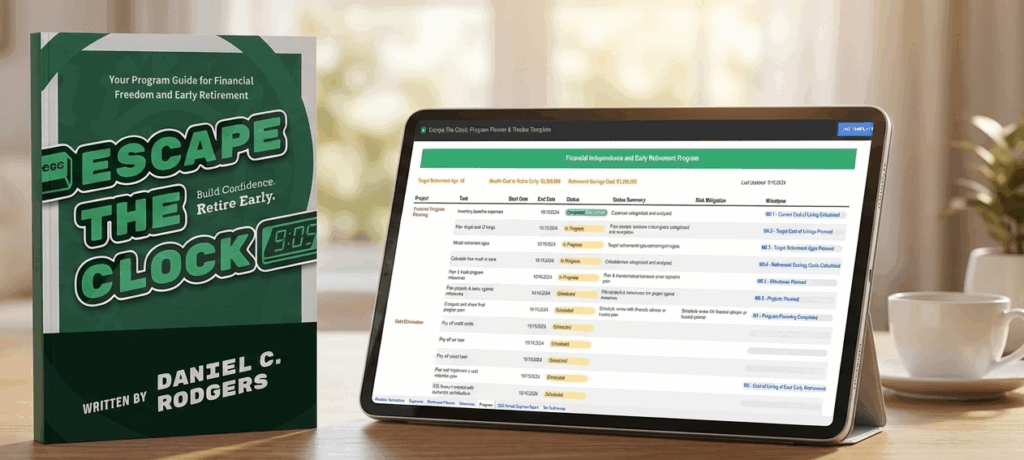

When I left, so many people asked me to help them do the same that I decided to spend some of my reclaimed time writing Escape The Clock. That book went on to become a best-seller and win multiple awards, including an American Writing Award for Best Personal Finance and Investing Book.

Now, I podcast and teach how anyone can apply those same disciplined, project management principles to their personal finances.

The Silent Pressure

You might think you are hiding the financial stress, but your family feels the weight. Money problems—even the ones we try to keep secret—influence our families and shape how our children grow up.

The stress comes from the unknown. It comes from looking at a 401(k) balance and having no idea if it is actually enough to live out your golden years, let alone buy your freedom. That uncertainty creates a “drift.” You drift through your career, trading time for money, assuming that because you are busy, you are making progress.

Activity is not the same as progress.

I was the same at first. I was on the treadmill, never moving forward, frustrated that each paycheck only got me to the next. Then I got organized. I began to get educated. I tried out strategies. Some worked, some didn’t. But because I had measurable goals, I could see what worked. I was no longer blind. I could finally flip the script on that implicit pressure holding me down and swim up to the surface for that breath of air I was so desperate for.

Turning Freedom Into a Program

The core philosophy of Escape the Clock is simple: Financial Freedom is a program.

A goal without a plan is just a wish. A “Program” has a defined scope, deliverables, and measurable milestones.

Think of your financial life as the ultimate set of projects. We don’t just say “Pay off Debt”. We decompose that into a series of easy-to-follow steps:

Task 1: Pay off Card A.

Task 2: Close Card A.

Task 3: Build Paydown Plan for Card B.

Etc.

When you can see and measure progress, you know every task is moving you closer to your goal of making work optional. There is a start date and an end date.

For your financial freedom the start date is the day you set the goal and the end date is the day work becomes optional.

Once you define those two points, everything in the middle becomes a math problem rather than a mystery. With a program to run, the vague anxiety disappears, replaced by direction.

The 3-Phase Methodology

My goal was to make the guide I wished had existed when I started my journey. The guide I wanted to hand my children and give to my friends.

Escape The Clock became that but so much more. The simple way it breaks down the overarching (and often overwhelming) goal of financial freedom into distinct phases has made it easy for anyone to build a personalized plan that actually works.

1. Define the Scope

Don’t just dream—plan. Know your numbers. Assess your financial baseline, project future needs, and set measurable milestones. Use the Smart Planner to capture your data and build a program that can be tuned, tracked, and shared.

2. Execute the Program

Turn your plan into action. Apply proven strategies as projects. Break projects down into actionable tasks and watch the needle move toward your SMART goals. Learn the financial strategies for independence such as building income streams, investing wisely, and detect financial risks early.

3. Transition to Freedom

Financial independence is the milestone; living on your terms is the goal. Learn to transition seamlessly from accumulation to distribution, ensuring you have the resources and the mindset to retire purposefully.

Every Great Finance Plan Needs a Powerful Tool

Paying for a financial advisor means having access to their education and their tools.

I ended up working with seven different advisors and two CPAs throughout my 20-year journey. I ended up firing most of them, not because they were terrible (even though a couple were), but because I simply outgrew them. In some cases, they created duplicate work for me, having me manually copy the data I already tracked in my spreadsheet into their tools, just so they could tell me to keep doing what I was doing. That is not worth a percentage of my net worth annually—not by a long shot.

No one is as biased for your financial success as you are.

With the right education and the right tool, you are in the driver’s seat. Now those discussions with a finance advisor are level. No preying on ignorance. No bullshit data. You have the capability to level the conversation. That is why I knew I had to make my personal smart tool available for everyone. Even if you don’t get the book, you should still get the Smart Planner.

Imagine sitting down with a finished Smart Plan for your financial freedom with a loved one or financial advisor, walking them through your goals, having the data on hand, and collaborating on how best to get there. That is real power.

Why Help You Escape The Clock?

Why am I spending so much of my early retirement volunteer teaching, hosting a weekly podcast, writing a blog, and helping people 1:1?

Great question. I can tell you it’s not for the money. Everything is free except the book, which is at the minimum price I was allowed to set with the publishers. Podcast hosting, equipment, distribution—all of that adds up fast. But that’s fine. I’m doing this because I’m enjoying it.

A world where everyone has the time to pursue their ambitions is a world I want to live in.

I like to imagine a world where no one feels trapped by the clock. A world where creativity is on overdrive and the limits of the human imagination are pushed. Work, while validating in many ways, is an ephemeral part of our lives that can suck away our best years. Yes, we are compensated for that, but consider how many hours of every day, week, and year you give to that job.

Now consider where you did not give that time. What are you putting on the back burner because you are too busy and drained with work?

I truly hope you give the program approach a try. Be it the book, the podcast, or these articles. Whatever it is, I genuinely want to help you get your time, health, connections, and happiness back.

And that starts by making the plan.