The Official Field Manual

Escape The Clock: Your Program Guide to Financial Freedom and Early Retirement

Start your program today. Order the award-winning best-seller.

📖 Available in Paperback, Hardcover, and eBook.

The

Advantage

Reclaim Your Time

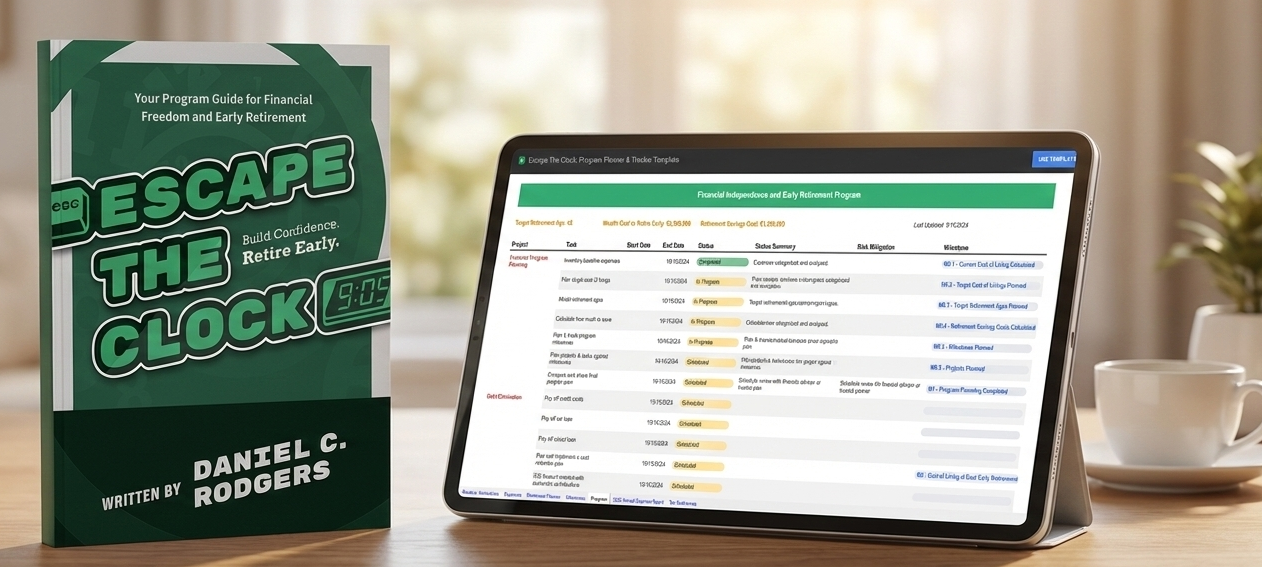

Financial freedom feels impossible until you treat it like a professional project. Just as large corporations break down complex strategies, Escape The Clock applies those same disciplined principles to your personal goals. This isn’t just theory—it is an actionable system to assess your baseline, project future needs, and manage risk with precision. Paired with the free Smart Planner, you will build a roadmap that can be tuned, tracked, and executed to turn ‘someday’ into a scheduled milestone.

Take the guesswork out of your financial independence, with the book and the Smart Planner you’ll clear the fog and clearly see the glide path to freedom and having the option to work on your terms.

The Escape The Clock Framework

1. Define the Scope

Don’t just dream—plan. Know your numbers. Assess your financial baseline, project future needs, and set measurable milestones. Use the Smart Planner to capture your data and build a program that can be tuned, tracked, and shared.

2. Execute the Program

Turn your plan into action. Apply proven strategies as projects. Break projects down into actionable tasks and watch the needle move toward your SMART goals. Learn the financial strategies for independence such as building income streams, investing wisely, and detect financial risks early.

3. Transition to Freedom

Financial independence is the milestone; living on your terms is the goal. Learn to transition seamlessly from accumulation to distribution, ensuring you have the resources and the mindset to retire purposefully.

Don't Just Read. Execute.

The book gives you the methodology. The Smart Planner gives you the control.

Download the free companion tool to model your scenarios and track your exit date.