Tracking Net Worth:

The High-Fidelity Metric to See Where You Are Going

Escape The Clock Insights

Most people believe the secret to financial freedom is a lucky stock pick or a high-salary job. They spend their energy chasing the perfect investment vehicle, believing that if they just earn more, the rest will take care of itself.

But the reality is that chasing a financial goal without tracking your numbers is like trying to pilot a plane with the gauges turned off. You might be moving forward, but you have no idea if you are climbing, stalling, or heading in the right direction.

According to a 2024 Charles Schwab Modern Wealth Survey, 47% of Americans do not have a written financial plan. They are effectively guessing their way toward retirement.

To design a life where work is optional, you have to stop guessing. You need a system that gives you the control to make rational decisions, the vision to spot opportunities, and the confidence to escape the clock.

That system is tracking.

Tracking is transformational. It can be a gut-punch at first, especially if you’ve been on autopilot for most your life. But once you do it, you’ll see where you stand, and more importantly where to go next.

Tracking your numbers isn’t hard. Read on to learn how.

Tracking is the lens that turns uncertainty into knowledge and guesswork into intention.

The Problem with Financial Autopilot

It is easy to fall into the trap of “financial autopilot.” This is where you follow the standard advice—max out the 401(k), pay the bills on time, and save whatever is left over—without ever questioning the destination.

You might be good at saving, but that doesn’t mean you are being intentional.

Jack Allweil, a real estate investor who rebuilt his financial life after a career setback, discovered this distinction the hard way. At age 27, he was fired. He had savings, but he realized he had been living passively. He was putting money away because he was “supposed to,” but he lacked a clear vision of what that money was actually for.

He realized that insurance companies don’t guess about their future liabilities; they track every variable with rigorous detail. He started applying that same actuarial rigor to his own life. The result? He stopped just saving money and started building a machine for freedom.

You can build wealth on autopilot, but you cannot build freedom without intention.

Income vs. Net Worth: The “High-Fidelity” Difference

We live in an income-obsessed culture. We define our financial success by the size of our paycheck. But income is a flawed metric for freedom because it only tells you one side of the story.

Income tells you where you are today. Net Worth is a high-fidelity metric because it tells you the direction you are heading.

When you only track income, lifestyle creep can eat up your raises without you noticing. You feel richer, but you aren’t actually getting closer to the exit. Tracking Net Worth forces you to look at the “velocity” of your wealth—how much of your hard work is actually sticking to your balance sheet and growing on its own.

Tracking Net Worth is like having a map with a compass. Your income, costs, debts, savings, investments, and taxes all become part of the picture. Suddenly, the fog is lifted and you can see the entire forest, not just the trees around you.

Income feeds your ego, but Net Worth feeds your freedom.

The Power of Data: A Case Study in Opportunity

The most common objection to tracking is, “I already know what I make and spend, so why write it down?”

The answer is that tracking reveals opportunities that intuition misses.

In 2019, Jack noticed a trend on his tracking spreadsheet: his home value was rising while his mortgage principal was slowly decreasing. Because he was monitoring the data monthly, he realized he had crossed the 20% equity threshold—a milestone he would have missed if he wasn’t paying attention.

This signal allowed him to execute a strategic refinance from a 30-year to a 15-year term.

- The Cash Flow: His monthly payment stayed roughly the same.

- The Net Worth Impact: He removed the Private Mortgage Insurance (PMI)—money that was previously evaporating—and drastically increased the amount going toward the principal.

- The Result: Instead of paying down $400 of principal a month, he was paying down ~$1,100.

Without tracking, he would have continued paying the same amount but keeping far less of it. The data revealed the opportunity to accelerate his wealth without changing his lifestyle.

What hidden moves might be buried in your data?

Data is the difference between working hard and working smart.

From Anxiety to Calculated Risk

The psychological benefit of tracking is perhaps even greater than the mathematical one.

When you fly blind, every financial decision is emotional. Spending $500 on a course feels reckless because you don’t know if you can afford it. Taking a pay cut to pursue a passion feels impossible because you don’t know your runway.

Tracking replaces anxiety with calculated risk.

When you know your numbers, you can play offense. Jack used his data to make decisions that looked risky on the surface but were mathematically sound. He spent thousands on a land-flipping course because he calculated exactly how many deals he needed to break even. He moved into options trading not as a gamble, but as a tracked income stream.

When you don’t know your numbers, every expense feels like a threat; when you do, expenses become investments.

How to Start Tracking Today

If you are currently flying blind, you don’t need to be an actuary to fix it. A simple two-step process can change your trajectory:

- Determine Your Personal “Price Index”: Start with expenses. You need to know what your life actually costs—not what the government says inflation is. Your personal inflation rate might be very different from the national average based on what you buy.

- The Net Worth Spreadsheet: Once you have a handle on cash flow, create a simple spreadsheet listing your Assets (what you own) minus your Liabilities (what you owe). Update it monthly.

It might be uncomfortable at first. You might even start with a negative number. But that number lets you live in reality. Even if you are not where you want to be, you can finally set up a plan to get there.

Once you have your spreadsheet populated then the hard part is done. Now it’s a simple matter of “data hygiene.” Every month, 6-months, or year (whatever you prefer), set a calendar reminder to update your sheet. Dump in the new expenses, update the changes to salary, savings, mortgage, whatever is relevant. And feel the power of seeing your progress.

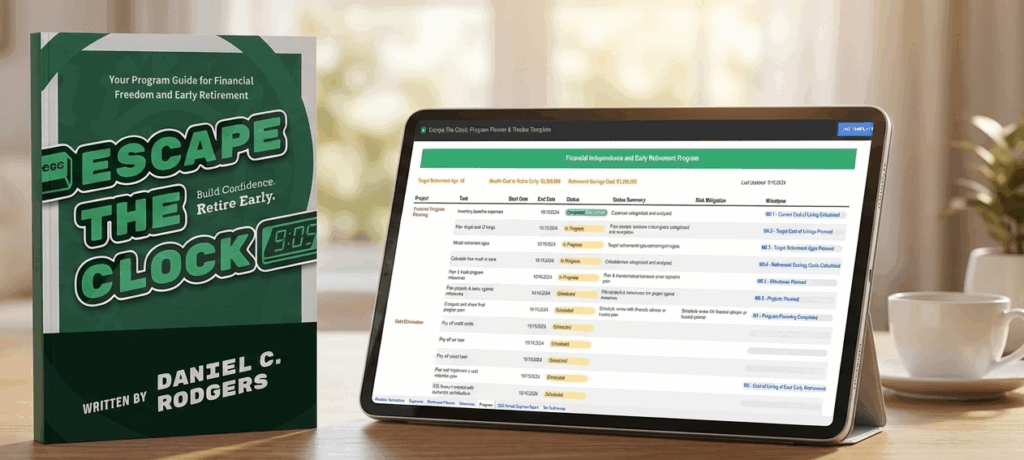

Don’t want to start from scratch and don’t want to pay for a tool either? Then I have the thing for you. The Escape The Clock Smart Sheet does it all. It’s 100% free, so what are you waiting for? Grab it at www.escapetheclock.com/toolkit.

Hope is not a financial strategy.

Learn More

A 2024 Charles Schwab survey found that 96% of people with a written financial plan feel confident they will reach their goals, compared to just 65% of those without one.

A plan is only possible with data, and tracking is how you get there. Imagine being able to answer how much you spend a year, how much you need to retire, and the exact age you can walk away. That is all possible with tracking.

Want to learn more? Listen now to my conversation with Jack Allweil:

We can’t cross the finish line if we don’t know where it is. But if you track your numbers, you can set a comfortable pace, and run forward with confidence that the future you dream of is closing in.